Log9 Materials is in crisis. Backed by the likes of Peak XV and PETRONAS Ventures, and having raised over , the startup is now overshadowed by debts, legal disputes, and mass layoffs.

The Core Of The Crisis: Its bold bet on manufacturing fast-charging and long-lasting Lithium-titanate (LTO) batteries has proven to be a strategic failure. For starters, LTO is a niche tech with limited mainstream use cases globally and is more expensive than lithium iron phosphate (LFP) batteries used in most EVs. Further, the tech offered by the company was ill-suited to India’s climate.

The China Problem: Log9 lacked the agility to develop in-house R&D and manufacturing expertise. Therefore, it had to rely on Chinese equipment and tech. On the other hand, competitors importing LFP cells were quicker to market and cheaper.

Damage Control: Inundated with customer complaints regarding the performance and cost of their LTO-powered vehicles, Log9 pivoted to LFP batteries last year. To fuel its new experiments, bogged itself down in debt as it almost ran out of cash.

The Fallout: After multiple pivots and tech failures, the EV startup is now embroiled in legal battles with customers and burdened with mounting debt. The financially strained startup has hardly any employees left and is in the process of selling parts of the company to keep itself afloat. The departure of a cofounder has further compounded its woes.

A Bleak Future: Facing a severe cash crunch, speculation is rife that Log9 will likely file for bankruptcy as it desperately seeks a financial lifeline. So, are we looking at yet another high-profile startup ? While you ponder the question,

From The Editor’s Desk: The foodtech major has shelved its delivery service, Swiggy Genie, across cities. The service, catering to nearly 70 cities, is not available on the Swiggy app at most locations. There is no concrete timeline for its return.

: Tarun Mehta and Swapnil Jain are set to rake in 15.2X returns each by selling a portion of their shares as part of the OFS during the company’s IPO. Meanwhile, IIT Madras and Tiger Global will rake in 40X and 8.3X returns, respectively.

: Indian startups cumulatively raised $54.7 Mn across 15 deals last week, down 46% from $100 Mn raised by 18 startups in the previous week. HexaHealth and Metafin took the biggest cheques home last week, pocketing $12 Mn and $10 Mn, respectively.

: Seventeen of the 32 new-age tech stocks under Inc42’s coverage gained between 0.13% and 10% last week. While Veefin Solutions and TAC Infosec were the biggest gainers, fintechs MobiKwik and Paytm emerged as the biggest losers.

: The OTT platform has come under fire over its reality show House Arrest, where female participants were made to enact sexually suggestive acts despite their refusal. NCW has summoned CEO Vibhu Agarwal and the show’s host on May 9.

: The ecommerce giant has challenged a Delhi HC’s verdict that directed the company to pay damages worth INR 339.3 Cr to Lifestyle Equities for alleged copyright infringement of the latter’s registered trademark Beverly Hills Polo Club.

Smart ring company Oura has won a preliminary case against the Bengaluru-based smart ring maker in a patent infringement lawsuit. The ruling could lead to an import ban on the deeptech startup in the US.

When Microsoft’s Satya Nadella said AI is killing software and SaaS, the tech world panicked. But LeadSquared’s Nilesh Patel sees it differently — not as a threat, but as a chance to embed AI, innovate, and deliver smarter SaaS tools that enterprises can’t ignore.

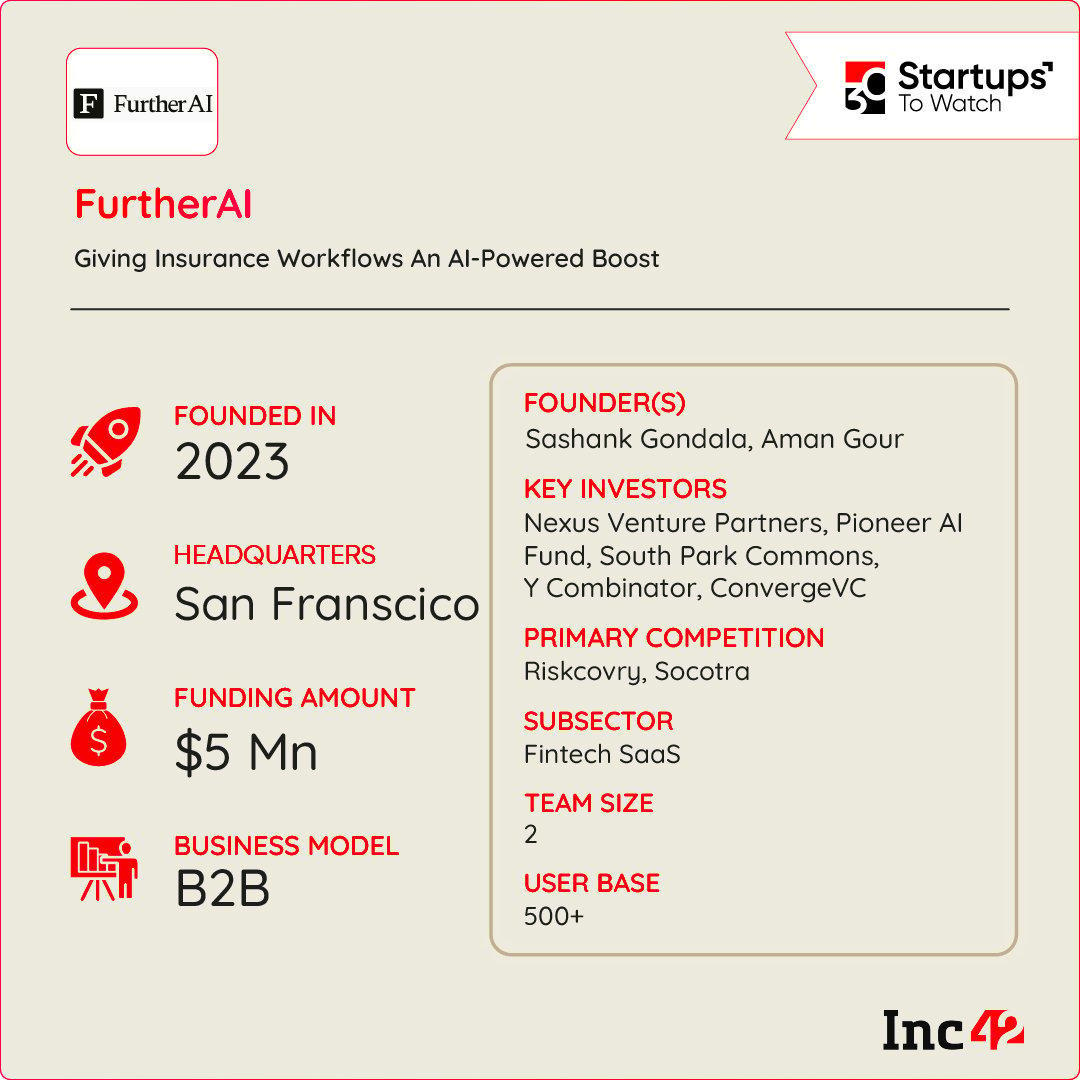

Inc42 Startup Spotlight How FutherAI Is Helping Insurance Agencies Double ProductivityInsurance agencies often grapple with challenges such as regulatory compliance, fraud detection, customer onboarding, and legacy systems. With an eye on automating the workflows of these companies and increasing the productivity of teams, IIT-Bombay alumni Sashank Gondala and Aman Gour founded FurtherAI in 2023.

The AI Booster Shot: The startup has developed AI bots that automate repetitive tasks such as unstructured data processing and data entry. Positioned as the ChatGPT for insurance, FurtherAI’s agents automate complex workflows like submissions processing, policy comparisons and underwriting audits.

The Y-Combinator-backed startup claims to use a combination of various large language models from Meta, OpenAI and Gemini to double the productivity of insurance agencies.

Eye On The Prize: Backed by Y Combinator, FurtherAI operates in the larger global insurance SaaS market, which is projected to become a $59.57 Bn opportunity by 2033. But the road ahead may be tough, as competitors like Riskcovry and Socotra are on the prowl.

With the insurance SaaS market expected to grow manifold over the next few years,

The post appeared first on .

You may also like

Delhi Minister Manjinder Sirsa, BJP Leaders Lash Out At Congress Leader Rahul Gandhi Over 1984 Riots And Lord Ram Remarks

John Cena's Skin Cancer Diagnosis: Why Sunscreen's Are EVERYDAY Essentials?

Pahalgam terror attack: India begins work on hydro projects after suspending Indus Waters Treaty with Pakistan

VIDEO: Massive Fire Breaks Out On Agra-Lucknow Expressway After Collision Between Vehicles

BOB Peon Vacancy 2025: Bumper recruitment in this bank for 10th pass, apply quickly..